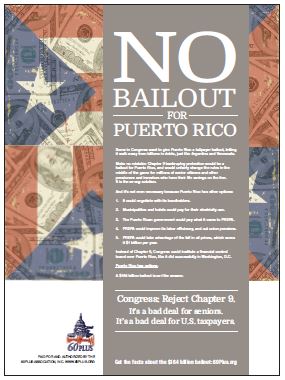

Congress is edging closer to granting Chapter 9 bankruptcy protection to Puerto Rico, a move that would allow the island to walk away from $164 billion in debt.

But this would shortchange millions of seniors, pensioners and other investors who placed their faith – and life savings – in Puerto Rican bonds, only to now see island’s government try to shirk its obligations.

Congress should reject H.R. 870:

Congress should reject H.R. 870:

The effort to pass Chapter 9 legislation for Puerto Rico is being undertaken by the House Judiciary Committee.

- Chapter 9 “would change the rules of the game,” and result in significant losses for senior citizens, pensioners and hard- working Americans.

- Congress needs to remember that the “Chapter 9 escape clause is a costly, and by no means a costless, solution. It would render a myriad of mainland investors vulnerable to potentially inordinate losses in multiple court-supervised workouts. Taxpaying bondholders from the fifty true states have already suffered major mark-to-market pain on their investments in Puerto Rico bonds.”

- Chapter 9 would allow Puerto Rico to “continue with bad governance and short-sighted economic policies that allowed it to descend into a financial abyss in the first place.”

The ‘Pierluisi-Garcia Padilla Plan’ allows Puerto Rico to walk away from its debts:

Resident Commissioner Pedro Pierluisi and Governor Alejandro Garcia Padilla have teamed up to essentially extort Congress, claiming that Puerto Rico will need a $164 billion bailout from Washington if Chapter 9 protection is not granted to the island. But it is hard to take serious the claims of Puerto Rico’s political leadership given its recent track record:

- Credit rating agencies have downgraded Puerto Rico as the island’s willingness to pay its debts has been sharply questioned.

- “Over the past year, Governor Garcia Padilla has undertaken a series of decisions that call into question his commitment to the rule of law and freedom of contracts…signed into a law in the dark of night a debt-avoidance bill…designed to allow the government to repudiate the billions in bonds they took out from unwitting U.S. investors… introduced legislation recently that would authorize the government to rip up previously agreed-to bond contracts.”

Puerto Rico has options:

Congress is being told that Puerto Rico is out of options and will need a bailout if Chapter 9 is not granted. This is false choice. Puerto Rico has options and solutions.

- It could negotiate with its bondholders.

- Municipalities and hotels could pay for their electricity use.

- The Puerto Rican government could pay what it owes to PREPA.

- PREPA could improve its labor efficiency, and cut union pensions.

- PREPA could take advantage of the fall in oil prices, which saves it $1 billion per year.

Congress has options:

Chapter 9 will have far reaching adverse effects on senior citizens and other pensioners and investors and taxpayers. Ultimately, Chapter 9 will not address these problems and others, such as concern about the rule of law, sanctity of contracts and the need for greater financial accountability. Puerto Rico needs long-term reform, and federal oversight mandated by Congress is central to any solution.

- Congress should consider enacting a Financial Control Board over Puerto Rico. A control board – similar to what Congress imposed over the District of Columbia 20 years ago – provides a path for Puerto Rico to become a responsible government that will pay its debts on time, reduce outsized influence of unions and implement pro-growth policies.